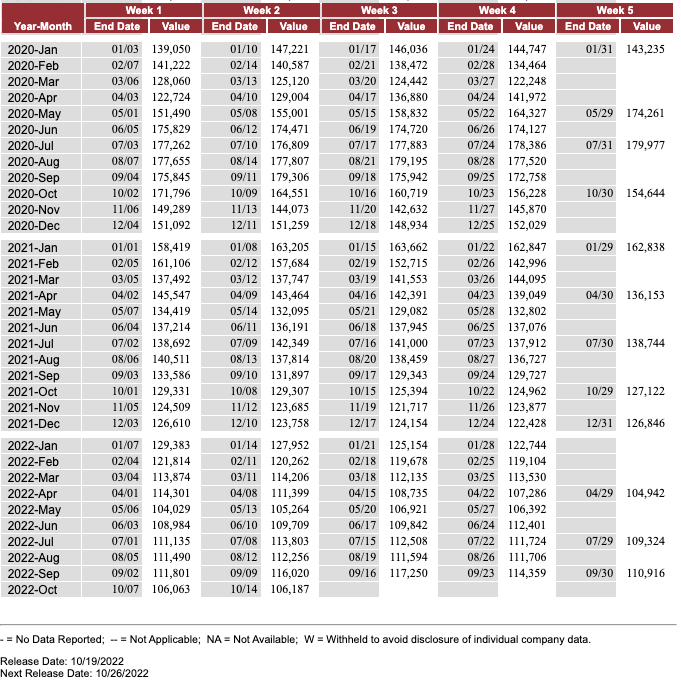

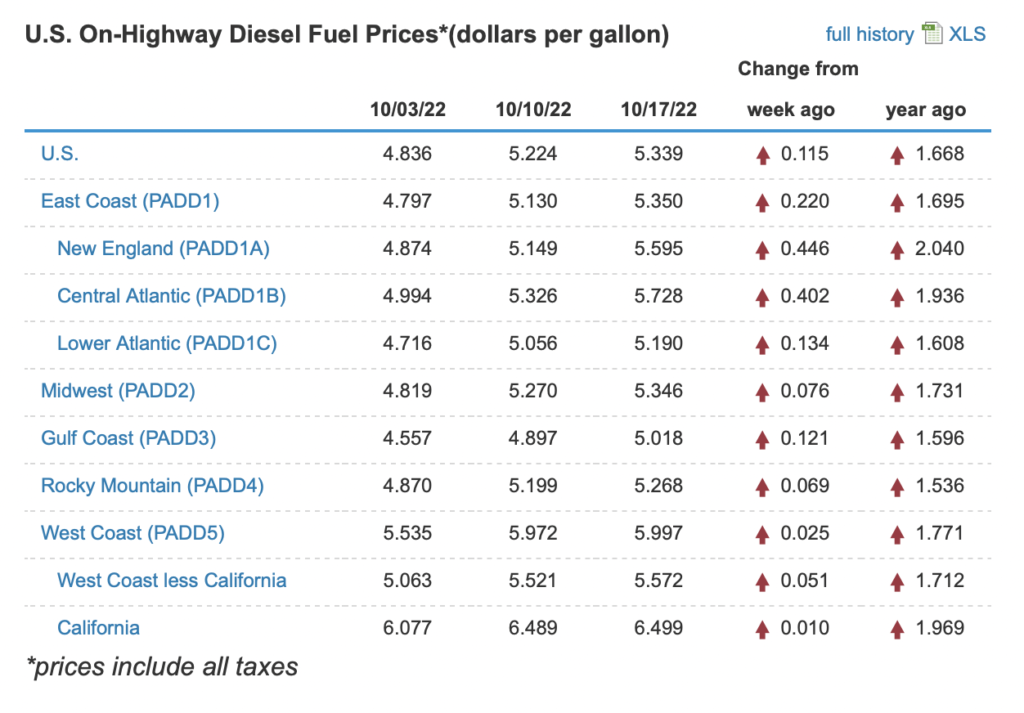

Recent diesel market reports that the US currently has a 25-day supply of diesel fuel (the lowest level since 2008) have caused alarms for many people who work in the industry. But it may not be as bad as the media is making it seem. Consider the table below:

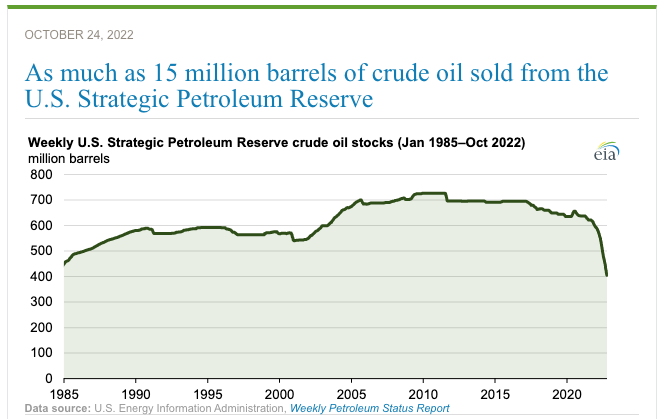

As much as 15 million barrels of crude oil will be sold between now and December; coming directly from the U.S. Strategic Petroleum Reserve. Director of the National Economic Council Brian Deese described the reserve levels as “unacceptably low.”

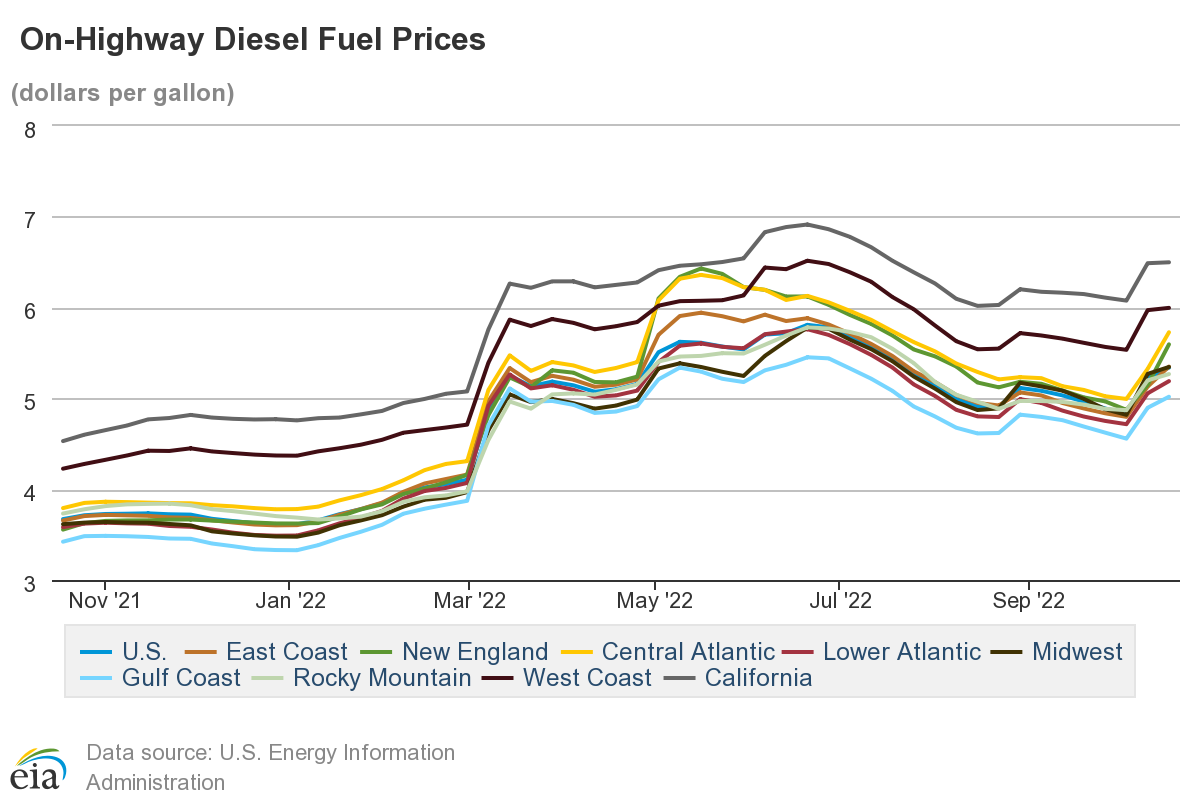

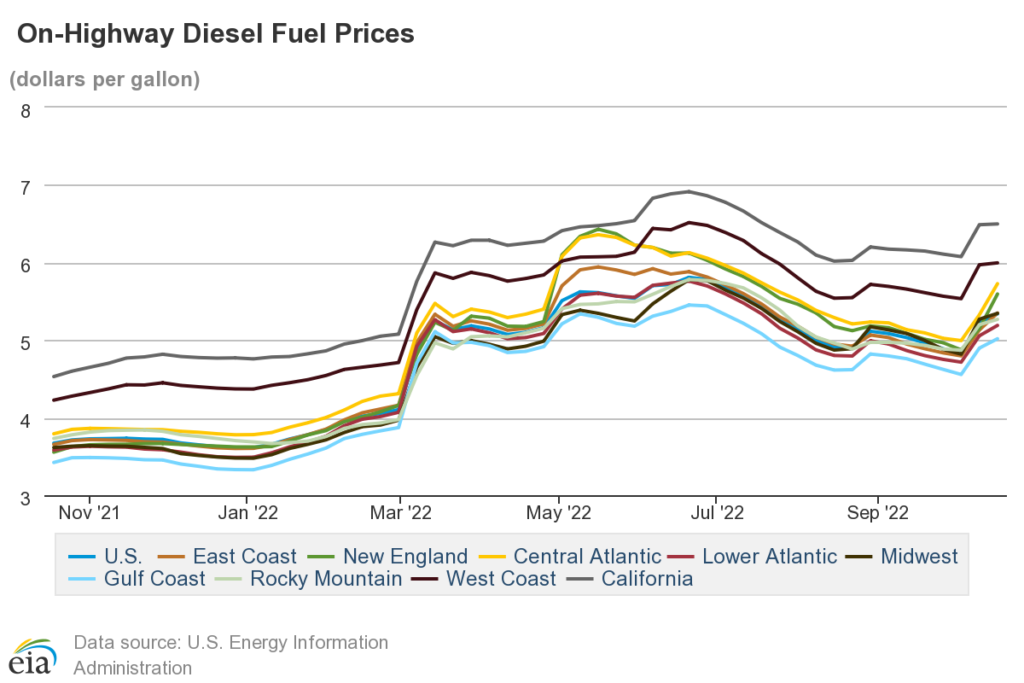

From a cost perspective, it looks like the price of diesel fuel will continue to slowly rise going into the winter. This is a relatively common trend given the current geopolitical environment paired with

market trends and patterns.

Although rising prices take a toll on business profitability, there are still things that you can do to reduce the cost. Tractor Performance Software, Fuel Card relationships, strategic route planning, and incentivizing drivers to prioritize efficiency are a few.

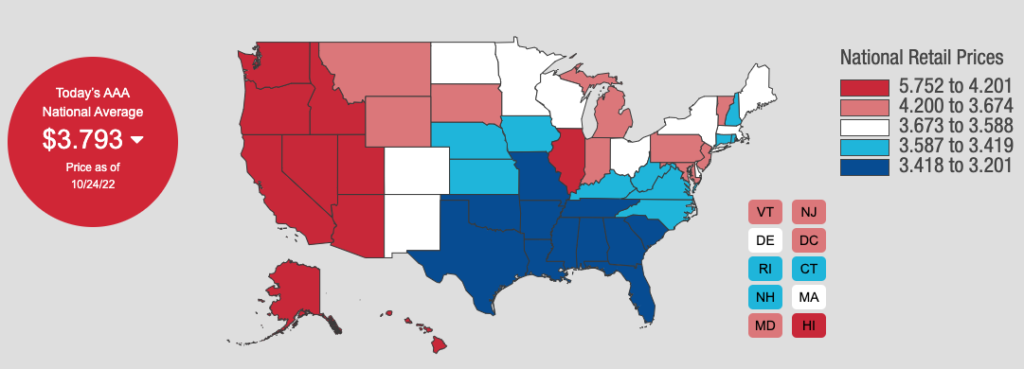

Nationally the diesel prices are over $5/gallon on average. But in some regions like the southeast, prices are between $3.20-$3.58 per gallon.

In locations like the New York Harbor, prices have jumped this week to more than $200 a barrel. The profit from converting a barrel of oil into a barrel of diesel, or the “diesel crack spread,” has reached a record high of $86.5 per barrel, up almost 450% from the average of $15.7 per barrel between 2000 and 2020.

Read our latest article on “How Factoring Companies Help Trucking Companies During Turbulent Times“.

A high-level overview of the global diesel industry

At the highest levels of the diesel market, there are a few companies and organizations that control the production, distribution, and sale of diesel fuel on a global scale. This includes large multinational oil and gas companies, such as ExxonMobil and Chevron, as well as national oil companies, such as Saudi Aramco and PetroChina. These companies control the majority of the world’s crude oil reserves and have the capacity to produce and distribute diesel fuel on a large scale.

In addition to these companies, there are also large global trading firms, such as Vitol and Trafigura, that play a significant role in the diesel market. These firms buy and sell diesel fuel on the global market and help to connect buyers and sellers around the world.

Overall, the highest levels of the diesel market are dominated by a small group of large, well-established companies that have the financial resources and infrastructure to operate on a global scale. These companies play a crucial role in determining the supply and demand for diesel fuel, as well as the prices that are paid for it.