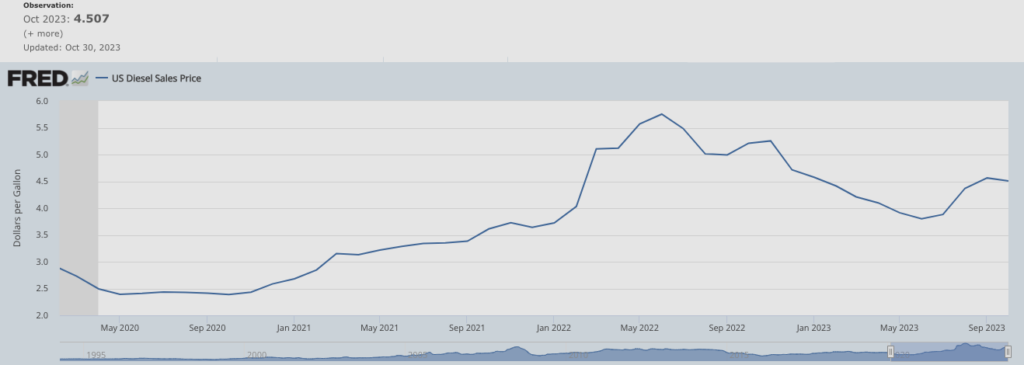

As of November 3, 2023, diesel fuel averages $4.45 per gallon, down from $5.17 in September 2022 but higher than the 2019 average of $3.06.

Impact on Transportation Costs and Broker Fees

High diesel costs are increasing transportation expenses.

Motor carriers pass these costs to shippers, resulting in higher freight rates.

Average van rate is $2.11 per mile, flat since September but down from $2.78 in August.

Reefer rates are at $2.47 per mile, and flatbed rates are at $2.50 per mile.

Broker Fees

- Broker fees are climbing due to increased freight rates.

- Brokers charge a percentage of the freight rate, so higher rates mean higher fees.

Rate per Mile

Van rates increased by 13.8% since September 2022.

Reefer rates rose by 11.6%, and flatbed rates by 13.2%.

Outlook

The EIA predicts an average price of $4.52 per gallon in December 2023, but non-governmental forecasts considering other metrics think diesel costs could be just beginning to rise.

Impact on Motor Carriers and Freight Logistics

Motor carriers face rising operating costs, leading some to exit the market willfully and others to close their operation due to financial insolvency.

This decreases capacity and drives up freight rates, which is positive in some ways. But puts industry participants in a state of future uncertainty. The carriers who may have just had a few bad quarters during The Great Reset, now face new regulations upon re-entry in addition to a more advanced competitive landscape.

Shippers grapple with higher costs, potentially reducing shipping volumes. As well as more migration to online platforms that automatically match shippers with carriers. These platforms expedite the facilitation phase but also allow for broker manipulation and van rate price arbitrage to consume valuable man hours at fleets booking loads manually which is a driving force behind the resistance among other challenges for wider load board adoption.

Consumer indicators paint the best picture of the current state of the industry. The future direction remains uncertain across the board. Potentially, increasing consumer prices could slow spending in certain categories leading to lower freight volumes. The outcomes of volume fluctuations will be different depending on the primary freight types in the areas. For example, the energy sector might see less of an impact from declining van rates or increases in consumer prices.

Industry Focal Points

- Carbon credit taxes: Carbon credit taxes are a market-based approach to reducing greenhouse gas emissions. They work by placing a price on carbon emissions, which incentivizes businesses to reduce their emissions. Carbon credit taxes are being considered in several countries, including the US.

- Fuel efficiency minimums: Fuel efficiency minimums are regulations that require vehicles to meet a certain level of fuel efficiency. Fuel efficiency minimums have been in place for cars and light trucks in the US for many years, but they were only recently extended to heavy-duty trucks.

- Speed governors: Speed governors are devices that limit the speed of vehicles. Speed governors are highly effective for improving fuel efficiency and safety. Speed governors mandates are also being considered as a way to reduce greenhouse gas emissions from trucks and reduce fatal accidents.

- Idle limiters: Idle limiters are devices that shut off engines after a certain period of idling. Idle limiters are used to reduce fuel consumption and emissions.

- Cloud-based truck performance updates: Cloud-based truck performance updates allow fleet managers to receive vehicle engine computer updates from manufacturers based on past vehicle usage. These updates produce changes in fleet fuel efficiency, and component lifespan, and reduce emissions.