Diesel is undoubtedly a vital commodity for modern economies. According to the US Energy Information Administration (EIA), diesel fuel consumption was around 1.11 billion barrels in 2021. This makes an average consumption of around 128 million gallons each day. You’ll learn about a detailed outlook on prices for diesel in the USA.

Furthermore, the prices for diesel fuel are one of the concerns that are not limited to businesses but also consumers. For instance, after dealing with high diesel fuel prices, consumers have less money in their pockets. Similarly, these high prices adversely impact businesses in the form of high transportation costs involved in managing daily tasks irrespective of the mode of transportation: truck, train, or ship. Ultimately, businesses have to shift these higher costs to customers through higher prices. High diesel prices bring a wave of inflation for people in an economy.

US Retail Diesel Price

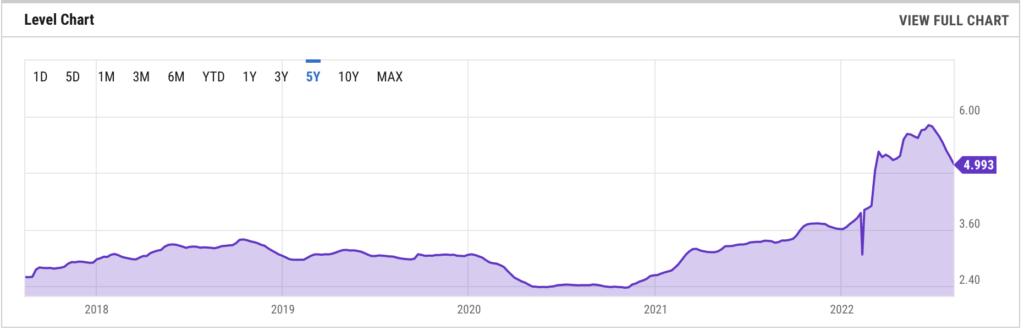

Analyzing the diesel fuel prices during 2021-2022 shows that the diesel fuel prices decreased sharply in February 2022 to $3.074 per gallon. However, post-February 2022, the prices have only increased. After hitting an all-time high of $5.81 per gallon in June 2022, the prices for diesel fuel have finally managed to decrease to $4.993 per gallon in August 2022 (this is a decrease of around $0.817). Compared to diesel’s price per gallon in August 2021, the price in August 2022 has soared by around 48%.

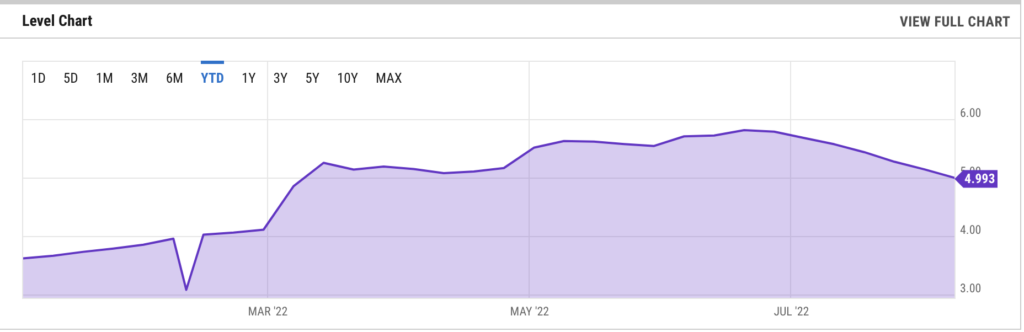

Prices for Diesel Fuel in 2022

In January 2022, the price of diesel fuel was $3.613 per gallon. However, it took a sharp dip in February, which decreased the fuel price to $3.074 per gallon – a 17.5% decrease.

But, this decrease did not last long, as the prices kept continuously rising, touching their highest price point ($5.81 per gallon) in July 2022. Furthermore, the prices have decreased since July, and currently, the prices hover around $4.993 per gallon.

The prices for diesel fuel differ across states in the USA. California sits at the top of the list with the most expensive diesel ($6.268 per gallon), followed by Hawaii.

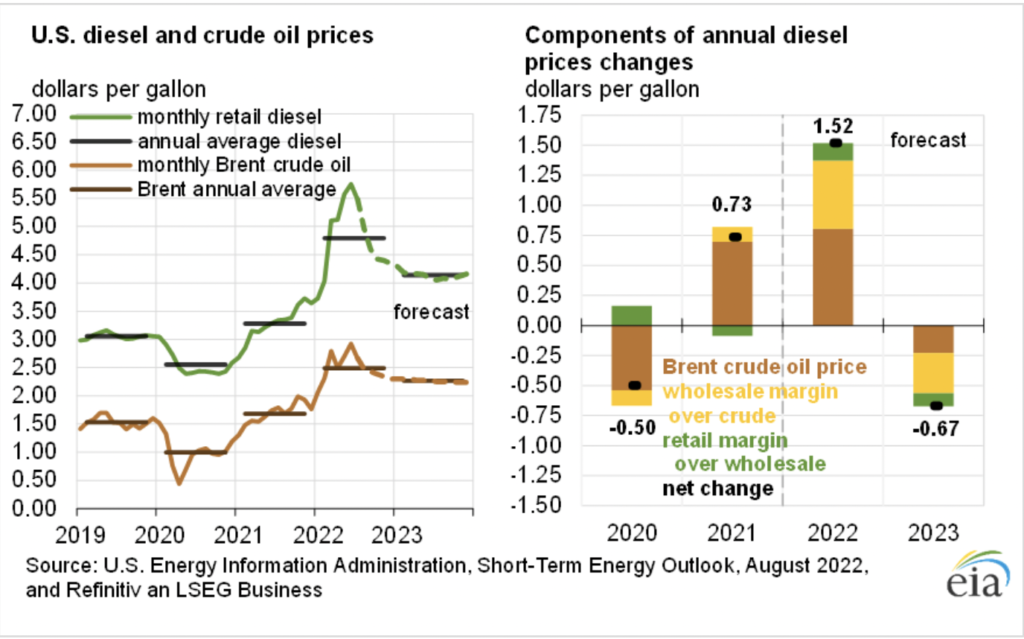

According to the US Energy Information Administration, the average retail gasoline price for Q3 2022 is anticipated to be $4.29 per gallon, while prices are predicted to fall to an average of $3.78 per gallon in Q4 2022.

History of Crude Oil Prices

To get a broader perspective on how crude oil prices, it is pivotal to analyze the pattern of how crude oil prices have changed in the last 25 years.

To begin with, it is important to note that, in the last 25 years, crude oil prices increased to their peak (around $140 per barrel) in 2008. The underlying reasons for this could be increasing demand, falling supply, and speculation in the market. However, despite such a high price, global crude oil prices managed to decrease to nearly $40 per barrel.

Crude Oil Prices in 2022

Until 2021, crude oil prices managed to be below $80 per barrel. However, the price rose over $80 per barrel in February 2022, and the Russia-Ukraine war further worsened the situation. Europe’s decision to move away from buying Russian oil has certainly contributed to the price hike, as the bloc used to import around 700,000 barrels per day of diesel from Russia.

On a 1-year chart, it can be observed that the crude oil prices per barrel have started to decrease from June 2022 to August 2022. This can be due to increased oil production capacity and fear of a recession.

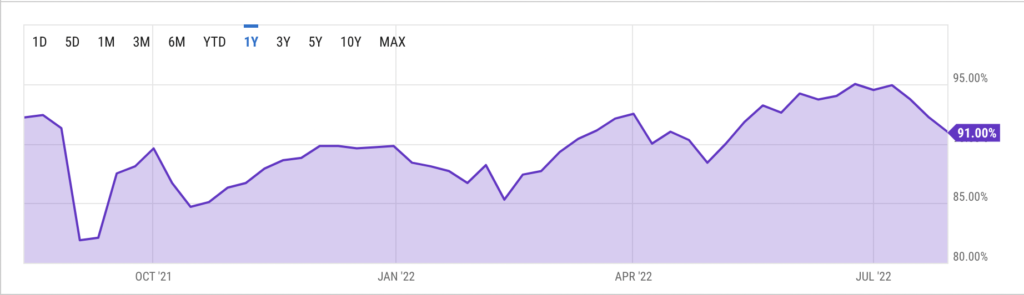

Fluctuating Diesel Capacity

The graph shows U.S. Utilization of Refinery Capacity from October 2021 to July 2022. In July 2022, the graph value hovers around 91%, a slight decrease from its earlier figure, 95%, in June 2022.

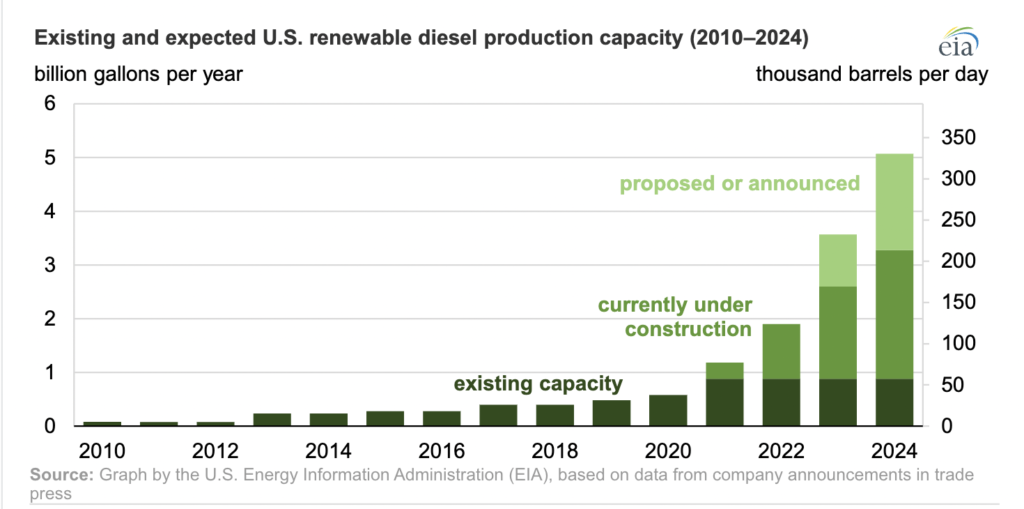

Moreover, As announced by EIA, US renewable diesel capacity could be expanded in the future because of the ongoing proposed/announced development projects. The projected growth is estimated to occur till 2024 due to the higher federal and state targets set for renewable fuel, beneficial tax credits, and the transformation of already established petroleum refineries into diesel refineries.

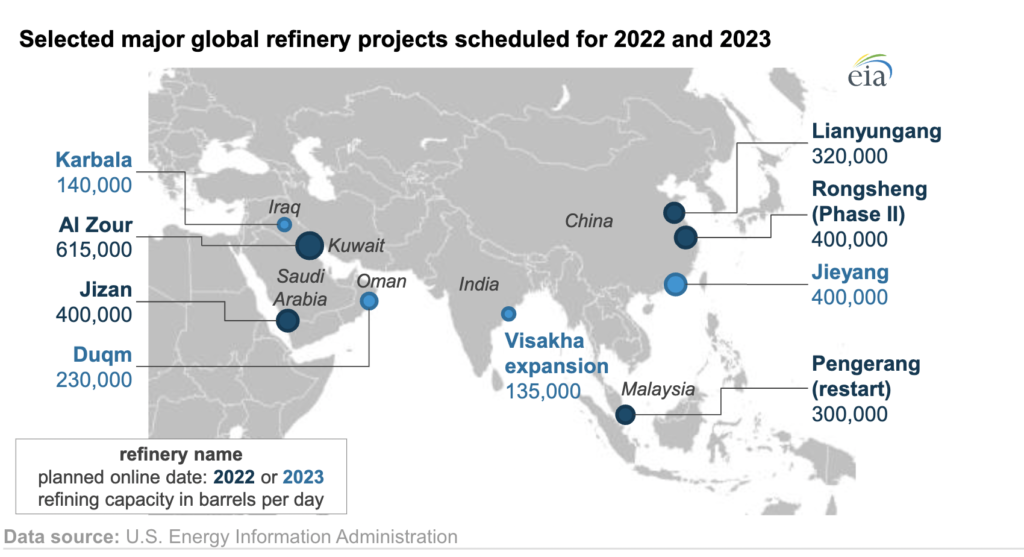

In addition, at least nine refinery projects are commencing operations or are planned to start production before the end of 2023. These projects will potentially add 1.6 million barrels per day in 2023. Also, China’s refinery capacity is planned to be increased substantially this year.

Will the Price of Diesel Fuel Decrease?

Russia should be considered when it comes to fuel production, as it is the largest oil exporter in the world. According to S&P Global Commodity Insights, Russia exports about 700,000 barrels a day of diesel to Europe. “The biggest driver of this dip is really the fact that investors are turning their attention to the possibility of a recession and how that could impact demand,” said Faisal A. Hersi, an energy analyst at Edward Jones. Investors are worried interest-rate hikes will slow down the economy as the FED is reacting aggressively against combating inflation.

Rising diesel prices can have a significant impact on logistics companies, as fuel costs are often a significant part of their operating expenses. To plan for rising diesel prices, logistics companies can take a number of steps, such as:

- Monitoring fuel prices and market trends to anticipate potential price increases and plan accordingly.

- Developing a fuel-management strategy that includes measures to reduce fuel consumption, such as optimizing routes, using fuel-efficient vehicles, and implementing speed and idle-time limits for drivers.

- Considering alternative fuel sources, such as natural gas or electricity, which may be more cost-effective in the long run.

- Implementing fuel surcharges or other pricing mechanisms to help offset the impact of rising fuel costs on their bottom line.

- Negotiating fuel contracts or purchasing fuel in bulk to take advantage of discounts and other cost-saving opportunities.

By planning ahead and taking proactive steps to manage fuel costs, logistics companies can help to mitigate the impact of rising diesel prices and protect their profitability.