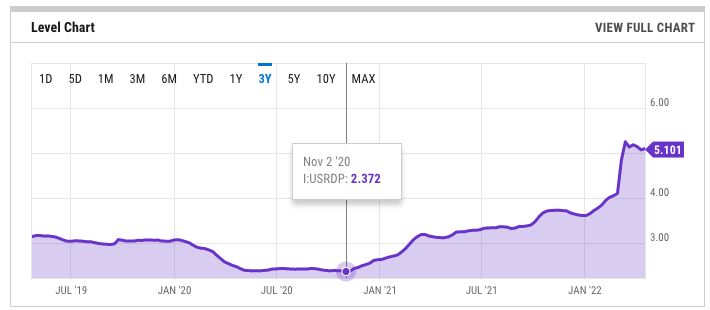

- Diesel prices dropped to $5.101 after reaching $5.18 per gallon in March.

- Trends point to increasing prices throughout the summer.

- Jet fuel prices are on the rise after refiners switched to diesel production.

The United States has seen an upward trend in Diesel prices for quite some time now. A single gallon of diesel fuel commanded an average of $5.11 in March which was an increase of $1 over the previous month making it the highest average price in years. However, the up-and-down roller coaster ride came to an abrupt end when the general cost of the fuel dropped to $5.073 on April 11th. Although, the price remains almost $2 above last year’s price.

Unprecedented Trends

After the initial increase in diesel prices per gallon at the beginning of March, it wasn’t clear whether the trend would level or continue in the upward direction. The trend saw the highest surge in eight years due to the recent global conflicts. Crude oil price trends are currently facing downward, thanks to recent centralized arrangements made by the US Energy Information Administration. As the summer approaches and the high-demand season rapidly approaches, expect pressure on the price of diesel in the US.

The annual report issued by the U.S. Energy Information Administration report stated that current trends indicate that consumers will only experience certain incremental relief points.

Outlook for Diesel Prices In 2022

In the first quarter of this year, diesel prices were cast at $4.30 a gallon which caused a significant stir among consumers. The U.S. Energy Information Administration has predicted an all-time growth in the prices during the second quarter, approximated at $4.82. Moreover, they project that the third quarter will see a drop of $0.50 per gallon.

The cost of diesel in California continues to be above the national average with a gallon sitting around $6.32. Next in line comes Central Atlantic with fuel prices approximately at $5.29. Overall diesel prices have seen a hike of over $1.99 this year alone.

Consumption Increases

According to the EIA, the significant prices are “a result of the slow financial retrieval from Covid as well as the political risk of investing in the oil market due to its volatile nature and risks”.

The question of whether gasoline prices will follow in diesel’s footsteps this summer is being raised as the US witnesses low production and strong demand for fuel.

EIA stated “We expect refinery utilization to continue increasing and remain elevated through the summer as long as crack spreads remain high, which will contribute to gasoline inventories rising above the five-year average by June and to gradually falling prices,”

Variables of Concern

It has been stressed that despite the obtainability of Russia’s crude oil, it comes with an uncertain forecast due to many factors that could affect production and exports. It also depends on the Global Response to the actions Russia is currently undertaking in Ukraine.

EIA has also lowered its oil price expectations, explaining that the cause was due to lower production in Russia.

The U.S gasoline market has been volatile this year, and with the cost of fuel on the rise, customers are reluctant to travel. Moreover, the possibility of new COVID variants continues to cast doubt on its future stability.

Jet Fuel to Diesel Fuel

With the onset of the second quarter of 2022, the cost of gasoline is taking its toll on American drivers. Likewise, airlines are experiencing higher prices at airports as jet fuel has doubled since last April. S&P Global Commodity Insights analysts said that the change is credited to the fall of Russian oil in the past weeks.

This has driven Western refiners to switch from manufacturing jet fuel to diesel. Leading to a shortage of fuel and a gap in the market, resulting in a price hike. This unwelcome rise in price threatens the already shaky recovery of the aviation industry after the pandemic.

With the summer demand for Diesel on its way, consumers across the US are hoping for relief after the continuous hike in prices. However, it is difficult to accurately predict the trajectory of fuel prices in the current climate. Realistically, the charts and trends point to significantly higher prices in the near future.